March 2024

Published March 18, 2024 337 Views

It’s not often that I read current industry news and am compelled to share my thoughts with the broader marketplace; now is one of those times. I am referencing the ongoing class action lawsuits being filled against the National Association of Realtors and several major brokerages regarding sell...

Competitive Market - 7 Tips for Helping Offer to Stand Out

Published June 28, 2023 7943 Views

Are you currently in the market for a new home? If so, you've probably noticed that competition for real estate is at an all-time high, with multiple offers over list price becoming increasingly common. Here at Premium Mortgage Corporation, we want to help you stand out from the crowd with some...

Is there really a new unfair mortgage tax on those with higher credit?

Published May 3, 2023 3809 Views

Let me try to dispel the myths and false claims that a borrower with a low credit score is getting better rates than a borrower with a higher credit score. Seemingly overnight, the internet has been filled with news regarding a "new," unfair tax on mortgage borrowers with higher credit scores...

Premium Mortgage Named One of the Fastest Growing Companies in Rochester

Published November 9, 2022 2681 Views

The Premium Mortgage Corporation family is celebrating being named to the 36th annual Greater Rochester Chamber Top 100, a program that recognizes the fastest-growing privately owned companies in the Greater Rochester region. Premium Mortgage Corporation is no stranger to the Top 100, having made...

Mike Donoghue Named a Top 30 Power Player in Rochester for 2022

Published November 1, 2022 2747 Views

We are proud to announce that our President and CEO, Mike Donoghue, has been named one of the region’s Top Power Players in banking and finance for 2022! The Power 30 is awarded annually and highlights the impact made by regional executives in banking and finance, education, law, manufacturing, and...

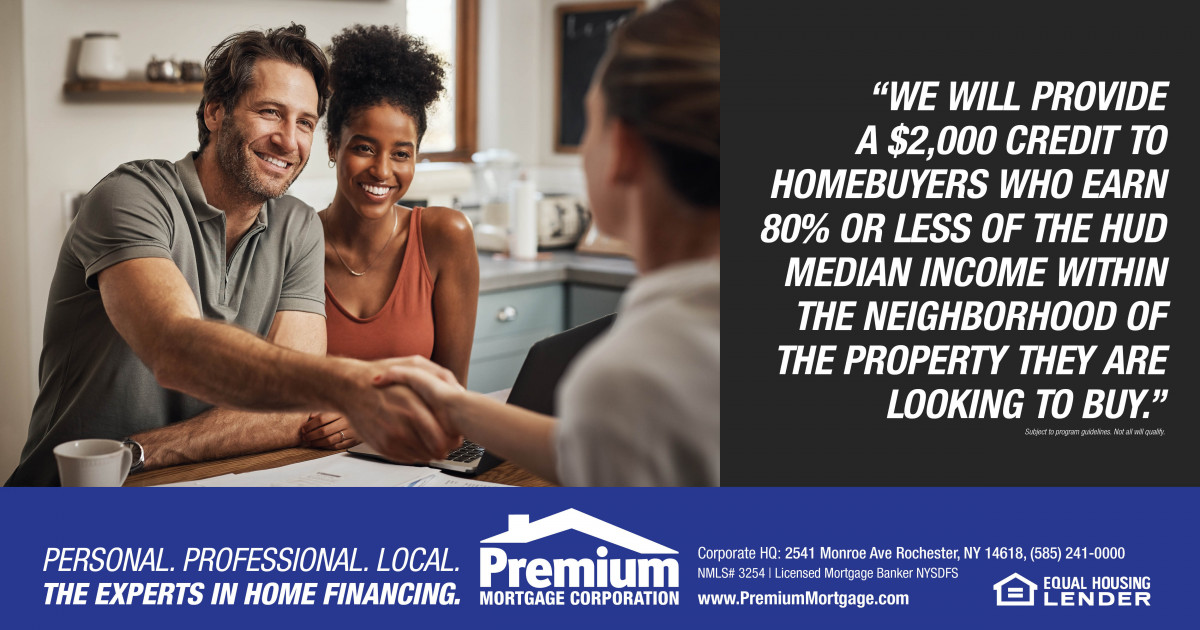

Premium Mortgage Corporation Launches Building Homeownership Program for Low-to-Moderate Income Borrowers

Published August 9, 2022 3464 Views

Achieving the dream of homeownership matters to our neighbors and neighborhoods. It helps create a foundation for families, unifies our communities, and empowers residents to put down roots. As a mortgage lender, we want to help make that dream a reality for all income levels—and that’s why we’ve es...

You Know Your Real Estate Agent is Right for You When…

Published March 11, 2022 3518 Views

Whether you’re buying a new home or selling your current one, your real estate agent plays an important role in the efficiency and success of the transaction. Additionally, finding the right agent for your needs can elevate your overall experience, and there are clear-cut signs when it feels like th...

Mike Donoghue Named a Power 100 Leader by The Rochester Business Journal

Published February 25, 2022 3868 Views

Premium Mortgage Corporation’s President and CEO, Mike Donoghue, has been named a Power 100 leader by the Rochester Business Journal. This is the second year the RBJ has compiled and showcased its Power 100 list, which highlights power players who are leading key organizations, creating change, and...

4 Tips to Help You Buy a Home with Student Debt

Published February 14, 2022 3582 Views

If you’re paying those dreaded student loan bills, it might seem like purchasing your own home couldn’t possibly be a short-term goal. After all, carrying a good chunk of debt raises your debt-to income ratio (more on that shortly) and can make it more difficult to save for a down payment. Even thou...

How to Start Building Credit From Scratch

Published January 24, 2022 3437 Views

Building credit from the ground up doesn’t happen overnight, but it’s not that daunting of a task once you know what lies ahead. After all, having an established credit history will help you get approved for things like a credit card, car loan, and eventually, a mortgage. While we’ve covered ways to...